Business Accounting Software: The Ultimate Guide for Small Business Owners

As a small business owner, keeping track of your finances can be a daunting task. With so many expenses and income sources to manage, it’s easy to get overwhelmed. This is where business accounting software comes in handy. In this guide, we’ll explore the top accounting software options available for small businesses, their features, and how to choose the best one for your business.

What is Business Accounting Software?

Business accounting software is a type of software designed to help small business owners manage their finances more efficiently. It automates tasks such as invoicing, payroll, inventory tracking, and financial reporting. It also provides real-time insights into your business’s financial health, allowing you to make informed decisions about your finances.

Benefits of Business Accounting Software

There are several benefits of using business accounting software, including:

Time-saving: Accounting software automates mundane tasks, such as data entry and report generation, saving you time and increasing productivity.

Accuracy: Manual bookkeeping can be prone to errors, but accounting software reduces the likelihood of errors and improves the accuracy of your financial records.

Insightful reporting: With accounting software, you can generate financial reports that provide an overview of your business’s financial performance, helping you make informed decisions.

Cost-effective: While some accounting software may have upfront costs, it’s usually more cost-effective than hiring an in-house accountant.

Top Business Accounting Software Options

There are several accounting software options available for small businesses, each with its unique features. Here are some of the most popular ones:

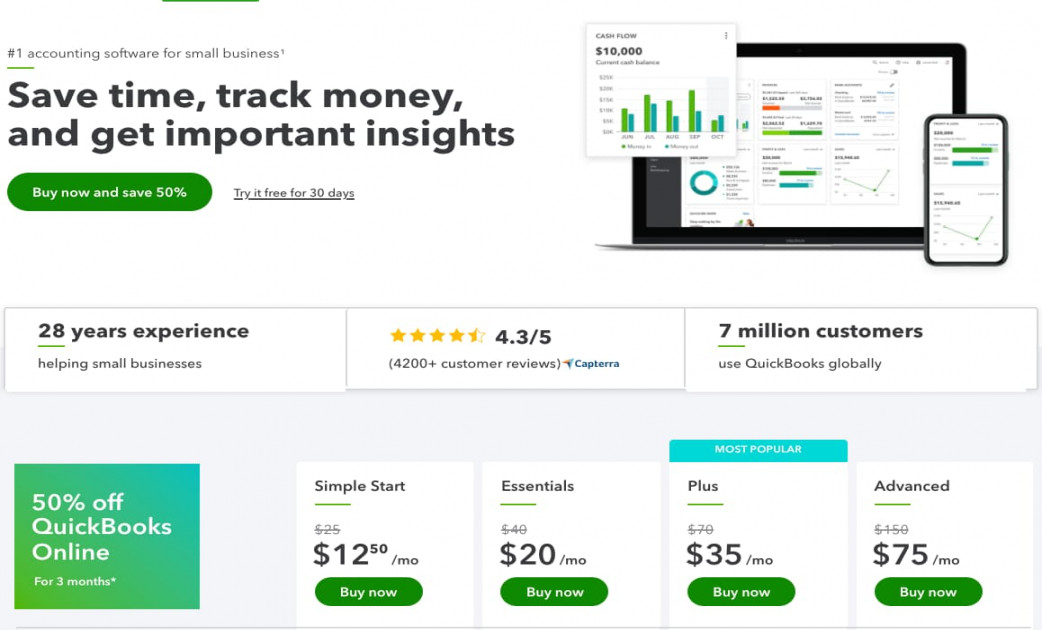

1. QuickBooks

QuickBooks is one of the most popular accounting software options for small businesses. It’s user-friendly and offers a wide range of features, including invoicing, expense tracking, payroll, and tax preparation. It also integrates with many third-party apps, making it a versatile and customizable option.

2. Xero

Xero is another cloud-based accounting software that’s popular among small businesses. It offers features such as invoicing, expense tracking, bank reconciliation, and payroll. Xero also has a mobile app, making it easy to manage your finances on the go.

3. FreshBooks

FreshBooks is a cloud-based accounting software designed specifically for small businesses. It offers features such as invoicing, expense tracking, time tracking, and project management. FreshBooks also has a user-friendly interface, making it easy to use even if you don’t have accounting experience.

4. Zoho Books

Zoho Books is another cloud-based accounting software option for small businesses. It offers features such as invoicing, expense tracking, project management, and inventory tracking. Zoho Books also integrates with other Zoho apps, making it a good choice if you’re already using other Zoho products.

How to Choose the Best Accounting Software for Your Business

When choosing accounting software for your business, consider the following factors:

Features: Look for software with features that meet your business’s specific needs.

User-friendliness: Choose software that’s easy to use and requires minimal training.

Cost: Consider the upfront costs and ongoing fees of the software.

Integration: Look for software that integrates with other apps and software you’re currently using.

Cloud-based vs. local: Decide whether you want a cloud-based or locally-installed software.

FAQs

1. What is cloud-based accounting software?

Cloud-based accounting software is software that’s hosted on remote servers and accessed through the internet. This means that you can access your financial information from anywhere with an internet connection.

2. Can I use accounting software if I don’t have accounting experience?

Yes, many accounting software options are designed to be user-friendly and don’t require accounting experience. However, it’s still important to have a basic understanding of accounting principles.

3. How do I choose the right accounting software for my business?

When choosing accounting software, consider factors such as features, user-friendliness, cost, integration, and whether you want a cloud-based or locally-installed software.

4. What types of features should I look for in accounting software?

Features to look for in accounting software include invoicing, expense tracking, payroll, financial reporting, and inventory management.

5. How much does accounting software cost?

The cost of accounting software varies depending on the software provider and the features included. Some software options may also have ongoing fees, such as monthly or annual subscriptions.

Conclusion

Business accounting software is an essential tool for small business owners looking to manage their finances more efficiently. With features such as invoicing, expense tracking, and financial reporting, accounting software provides real-time insights into your business’s financial health. When choosing accounting software for your business, consider factors such as features, user-friendliness, and cost to find the best option for your specific needs.

Discussion about this post